MCC’s insights from the world’s largest electronics show

Last month, electronica 2022 did not disappoint! After four long years of waiting to meet in person, nearly 70,000 attendees from 100 countries and regions attended the event in Munich.

| After meeting with major players, customers, distributors, potential customers, and OEMs at the show, we noticed some market trends and opportunities, especially in two important industries — Automotive and Industrial. |  |

Automotive Trends & Opportunities

Accounting for just 8% of semiconductor demand in 2021, the automotive industry could represent 13 to 15% of demand by 2030.

Modern vehicles can contain 8,000 active semiconductors and 100 interconnected control units. With the EU’s commitment to ban the production of gas-engine cars and vans by 2035, the number of semiconductors and control units per vehicle is bound to climb, along with even greater demand. Plus, increased autonomous driving features and e-mobility are also key drivers.

Many of these challenges were discussed at electronica’s CEO Roundtable, where leaders of NXP Semiconductors, STMicroelectronics, Infineon, and Wolfspeed discussed the many issues and opportunities surrounding the semiconductor industry today — from supply chain problems to labor shortages.

These CEOs confirmed what we see in the market — the increased popularity of EVs is driving demand for high-power products, MOSFETs, and SiCs. It’s to the point where some of these semiconductor manufacturers confessed they can’t even keep up with demand. However, our lead times are better than the industry average, so MCC can help you source the right MOSFETs, SiCs, or other components for use in EVs.

Automotive is the most crucial segment in Europe, with many Tier 1 and Tier 2 customers scattered around.

These customers still suffer from severe shortages over the last 1.5 - 2 years, with massive price increases adding insult to injury. In addition to increased prices, they often find unwanted surprises such as delivery delays, especially for analog parts and MOSFETs. These automotive customers are painfully aware that relying on one top-tier supplier without a backup will no longer cut it.

Finding an alternative supplier for the auto industry is a long process due to the stringent automotive qualification process. The sum of these challenges led to a drastic decrease in production. Going forward, most automotive customers will implement a strategy to qualify at least one dual source on every new project.

Automotive Component Outlook

- Discrete power MOSFETs - The 40V, 80V, and 100V options will remain on manufacturers’ priority list, mainly because 40V can be used in vehicles with 12V batteries. For vehicles with 48V batteries, the 80V and 100V solutions will be ideal. Many industry professionals we spoke with prefer the 5mm x 6mm DFN package. However, MCC is launching a new MOSFET in early 2023 (DFN5060), a 40V 1mohm with a smaller footprint and AEC-Q101 compliance. Several customers have tried it out in the preliminary design and are pleased with it. Great news for customers — the average lead time on our product is 16-20 weeks, which is better than other components in the marketplace.

- Discrete small signal MOSFETs - Automakers are looking for smaller, more lightweight components for use in automotive light bulbs, sensors, and other products. Packages including DFN2020, DFN1010, and DFN0606 offer a smaller surface volume. MCC has these sizes on our new product roadmap, and will roll them out in 2023. In the meantime, leadless options could help customers find the compact size they are looking for.

- SiC MOSFETs on the rise - Because the UE is banning combustion engine cars and vans by 2035, onboard and off-board chargers are in greater demand. Many are looking into Silicon Carbide MOSFETs to maximize efficiency by replacing IGBTs or Silicon MOSFETs. We offer a SiC MOSFET ideal for off-board chargers with various ranges, including 1200V 80k ohm in TO247-3/TO247-4 package sizes to 1700V 1 ohm in TO247-3. We also have a roadmap for a SiC MOSFET that is 1200V 40k ohm and 28 ohm, which will enhance performance.

Industrial Trends & Opportunities

According to Quince Market Insights, the global Industrial Internet of Things (IIoT) market is expected to grow with a CAGR of 21.3% from 2020 to 2028, with advancements in manufacturing as one of the key factors.

Our conversations with experts in the field revealed the Industrial market is a major one in Germany and Europe, with enhanced demand for:

Manufacturing Equipment |

Power Supplies |

Solar Inverters |

While some are moving from IGBT technology to SiC MOSFETs for greater performance, many designers and manufacturers are balancing costs and sticking with IGBTs for the foreseeable future (until SiC MOSFETs come down in price).

Like customers in Automotive, many are struggling with product availability from their existing suppliers. Therefore, longer lead times are forcing companies to qualify a secondary source for new projects.

Industrial Component Outlook

Fortunately for MCC and our customers, we have IGBT components in 650V and 1200V, with currents ranging from 15A to 75A and lead times of an average of 16-20 weeks compared to approximately 39-52 weeks for other IGBT manufacturers.

We’ve seen a lot of interest in our IGBT modules and power diode modules as long-term solutions for customers feeling the crunch of longer lead times.

MCC showcased three NPIs made for these growing markets

Did you swing by our booth at electronica? The MCC booth featured the three new products we rolled out in 2022:

Automotive Schottky Barrier Rectifiers

MCC's automotive Schottky barrier rectifiers are made for low-power, high-efficiency applications. Features include:- High efficiency, low power loss

- High voltage (up to 200V) and current capabilities (up to 15 A)

- Green and halogen-free

- Ideal for low-power, high-efficiency applications

- AEC-Q101 qualified

See Product Details

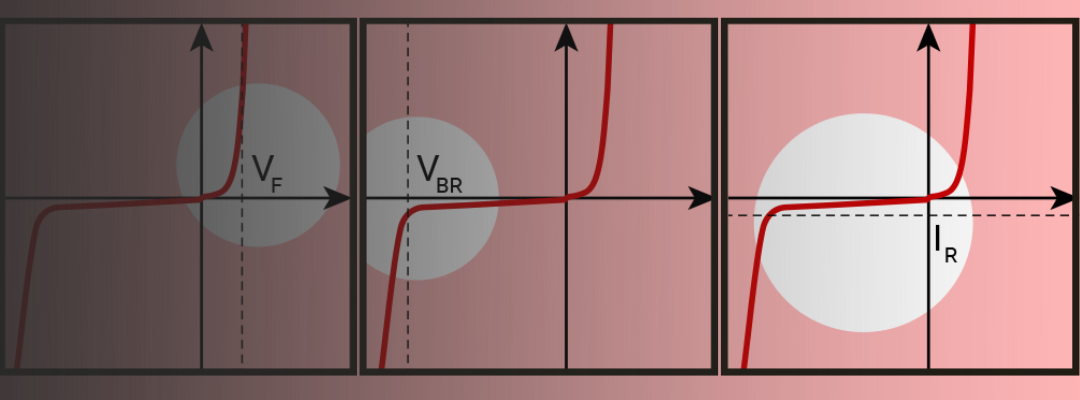

600V, 800V Low VF Bridge Rectifier

Our low VF bridge rectifier delivers high reliability, plus:

- Low VF, Low IR, High IFSM

- Available in GBU or CBJ packages

- High current capability

See Product Details

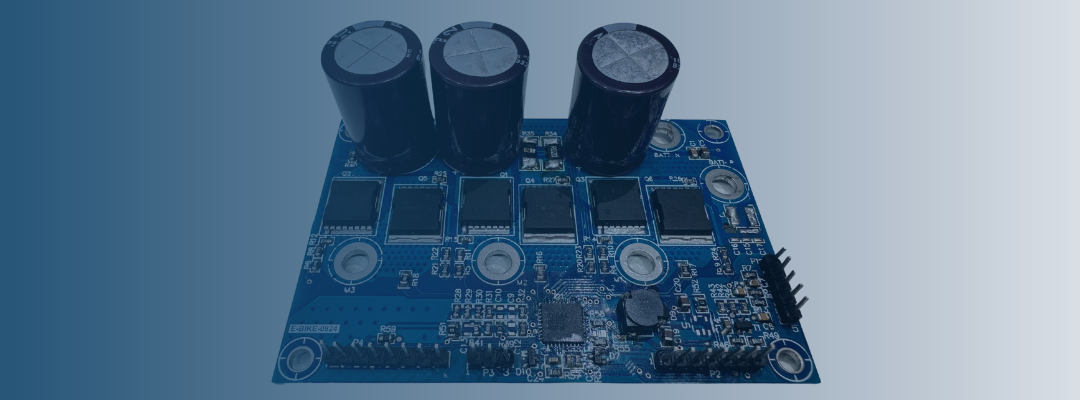

650V, 1200V IGBT

Our new IGBTs leverage Trench-Field Stop technology to deliver superior current conduction capability and more:

- Low Vce for low conduction loss

- Low Eon/Eoff for low switching loss

- High current conductivity

- Easy to parallel

- Ideal for photovoltaic and industrial applications

See Product Details

These NPIs we showcased at electronica are a perfect fit to meet market demands in Automotive, Industrial, and beyond. Stay tuned next year for several new products designed to make your products better and more competitive.

Other Highlights & Cool Stuff from the Show

Our team also got to walk the halls of electronica to see what other innovators in electronics had to share.

From robotics to electric vehicles, here’s a fun look at some of the cool technologies we spotted at electronica:

We’re already looking forward to returning to electronica November 12-15, 2024, and hope to see you there!

Until then, be sure to subscribe to our blog to stay in the know on what’s trending in semiconductors.

Have questions? Use the MCC website chatbot for fast, convenient support.

.png?width=50&height=50&name=mcc%20150x150%20(1).png)